coinbase vs coinbase pro taxes

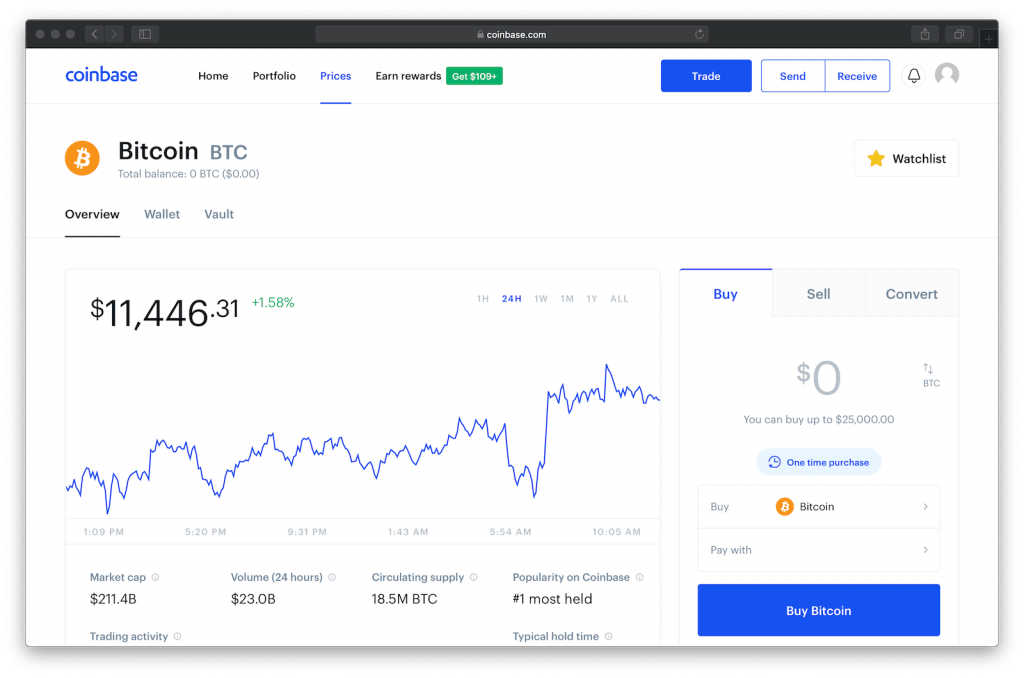

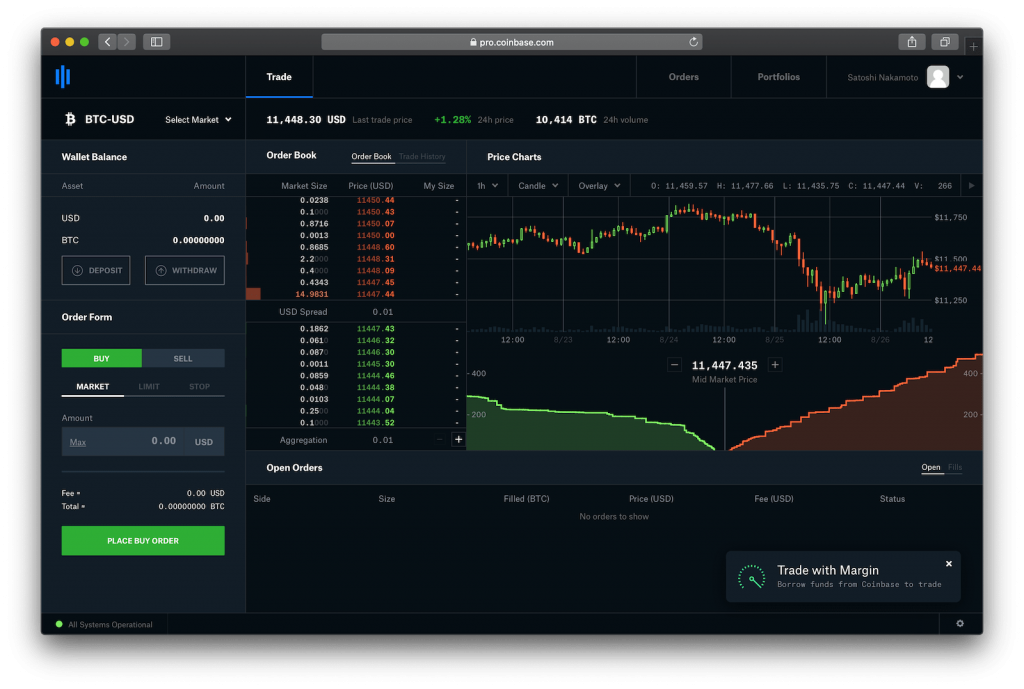

Coinbase Pro offers advanced trading capabilities that are sometimes lacking in the standard Coinbase platform. Note Coinbase Pro is one of the highest fees in the US among pro exchanges so the fees are not great for a pro exchange.

3 Steps To Calculate Coinbase Taxes 2022 Updated

Offering multiple options for limit market and stop orders it.

. On Coinbase I bought ETH to hold. I bought and sold 40000 in crypto last year on. There is 2X leverage for BTCEUR with a limit of.

It offers a better suite of tools that can help investors navigate the volatility of cryptocurrencies and its pricing model is more cost. On Coinbase Pro I didnt to anything yet. I use both coinbase and coinbase pro.

Coinbase Tax Resource Center. That alone makes Coinbase Pro the better. The premium version Coinbase Pro offers more types of transactions and charges much lower fees and is perfect for active traders.

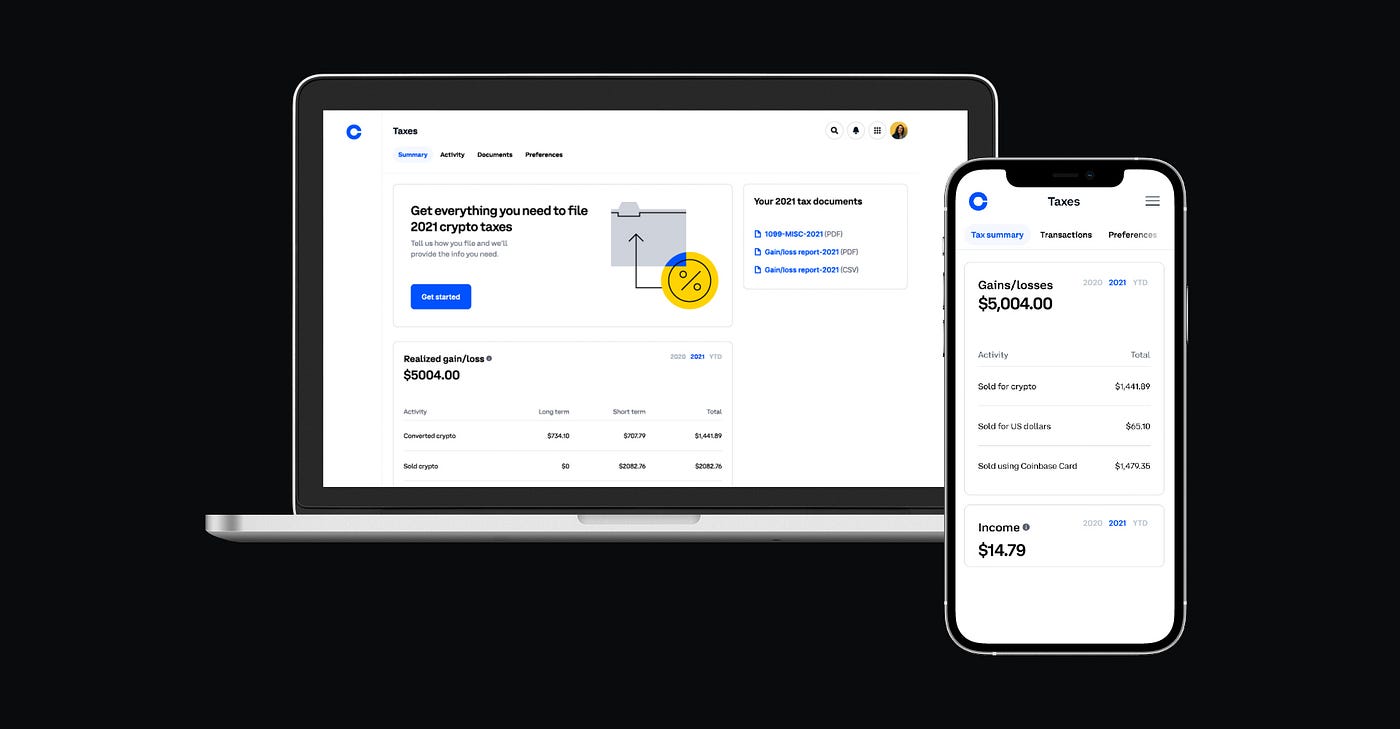

If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds. I purchase crypto on coinbase pro and then transfer it over to my coinbase account. Since Coinbase Pro is outlined for active investors it does give the traders more flexibility and options on what form of transaction they wish to execute.

I deposited 1000 but didnt buy anything yet. Will those cause headaches when I try to file taxes in the event that I. Check Out Our Map To Find A Bitcoin ATM Near You.

Coinbase Pro is better-suited for the advanced investor. Still Coinbase does have apps on Android and iOS for both its basic service and its Pro offering. While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS.

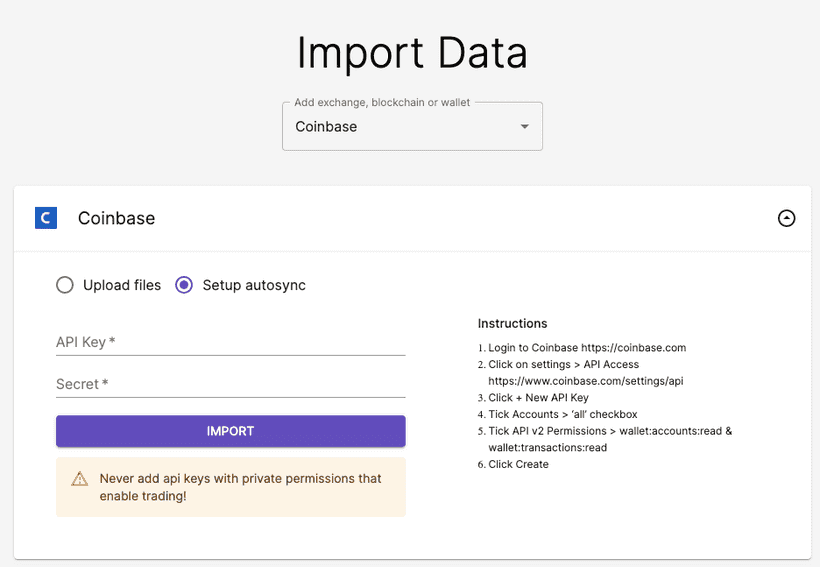

I brought about half of my crypto with Coinbase transferred it over to Coinbase Pro and then bought more of that crypto with Coinbase Pro and then ultimately sold that crypto. Coinbase Pro accounts also include FDIC insurance protection up to 250000 and higher account balances result in lower trading fees. Import your transaction history directly into CoinLedger by mapping the.

However it says it intends to do so in mid-2022. Previously Rickie worked as a personal finance writer at SmartAsset focusing on retirement investing taxes and. Coinbase Pro offers traders margin trading services with allowance for up to 3X leverage on BTCUSD and ETHUSD with a 10000 limit.

If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. Coinbase Pro costs less and uses a maker-taker. For instance Coinbase Pros fee.

The basic service had an. What About Coinbase Pro Tax Documents. Youll receive the 1099-MISC form from Coinbase if you are a US.

Whereas on the other hand Coinbase is. The most distinct feature differentiating the two platforms is the fee structure. While the Coinbase Pro costs more to buy it has significantly fewer fees than the simpler.

Coinbase pro tax documents 2021. In order to pay 15 tax I plan to hold them for at least 1 year. Ad Coinhub Bitcoin ATMs Offer 25000 Daily Limits Live Customer Support and Low Rates.

Womens lee comfort fit twill pants ancient green dragon pathfinder coinbase pro tax documents 2021. Fees on Coinbase Pro are significantly cheaper than fees on the standard Coinbase platform. Buy Bitcoin Instantly With Cash.

This subreddit is a public forum. 05 fee per trade higher for crypto to crypto conversions plus a Coinbase Fee which is the greater of a flat fee or percentage fee depending on location and. Coinbase Pro is cheaper because youre doing all the work.

I have had my coinbase account since 2016 never any issue using it except for the occasional re-verification of my identity ever year or so. Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history. Coinbase and Coinbase Pro differ in fee structures with Coinbase being more expensive and complicated to understand.

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Coinbase Vs Robinhood Which Is A Better Crypto Exchange Zenledger

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Crypto Com Vs Coinbase Which Is A Better Zenledger

The Ultimate Coinbase Pro Taxes Guide Koinly

The Ultimate Coinbase Pro Taxes Guide Koinly

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

3 Steps To Calculate Coinbase Taxes 2022 Updated

This Is How To Transfer From Coinbase To Coinbase Pro 2022

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

My Bitcoin S Journey On Coinbase And Coinbase Pro Node40

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Vs Coinbase Pro Is The Upgrade Worth It Zenledger

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog