travel nurse state taxes

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Tax break 3 Professional expenses.

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

Simply put your tax home is the state where you earn most of your nursing income.

. 250 per week for meals and incidentals non-taxable. Here is an example of a typical pay package. Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home.

2000 a month for lodging non-taxable. And how this distinction is the main source of confusion among travelers recruiters and staffing agencies who try to determine whether travel reimbursements. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes.

2021 has been a unique year for travel nurses and some pay packages were different from traditional travel. Travel nurse earnings can have a tax advantage. For example if you live in Arizona and take a nursing job in Oregon that lasts for several months your tax home might end up being Oregon rather than.

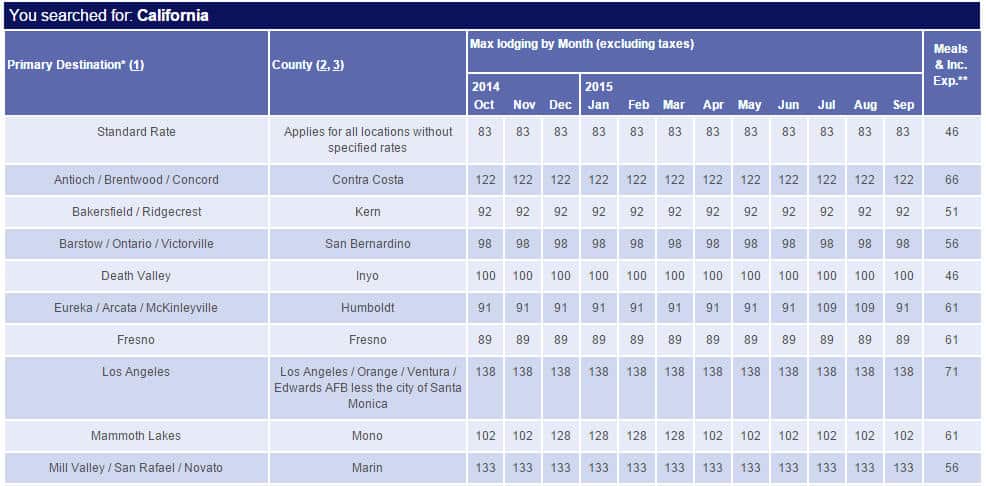

In California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500 per week for Meals and. Travel Nurse Tax Deduction 1. The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home.

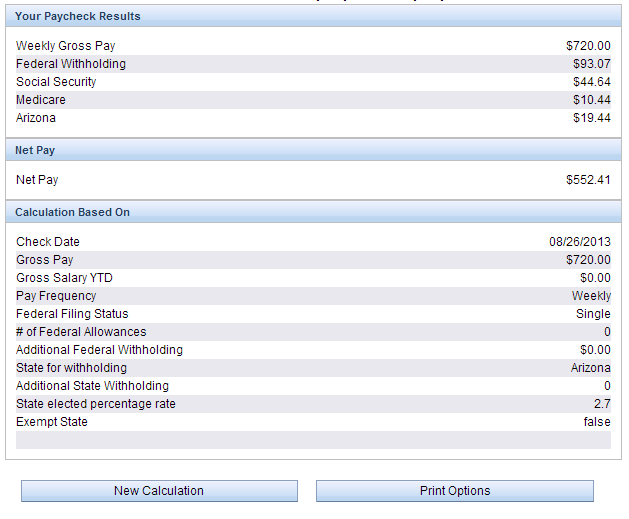

This means theyll have to calculate and remit all taxes to the IRS and state authorities. For W2 employees FICA tax of 153 of gross earnings is deducted from their paycheck to fund social security and medicare and their employer pays for half of the tax. 20 per hour taxable base rate that is reported to the IRS.

Deciphering the travel nursing pay structure can be complicated. FEDERAL AND STATE TAX PREPARATION. However this can also make your taxes tricky.

FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. But it is pretty close. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals.

Tax day is April 18 2022 and you might be wondering about filing taxes as a travel nurseWere not tax pros and we recommend talking. Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence. Not just at tax time.

In this case it is 25720 before taxes or 5495hour. Basically only income earned in California is taxed there. This makes it very easy to compare two contracts total value.

Tax deductions for travel nurses also include all expenses that are required for your job. For general questions and answers on salary and open positions complete the form for a quick question call 800-884-8788 or apply online today. FREE YEARLY TAX ORGANIZER WORKSHEET.

500 for travel reimbursement non-taxable. INDEPENDENT TAX ADVISORY CONSULTING. This is the most common Tax Questions of Travel Nurses we receive all year.

This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses. For true travelers as defined above the tax rules allow an exception to the tax home definition. File residence tax returns in your home state.

It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Tax-Free Stipends for Housing Meals Incidentals. But I Didnt Work Thereand similar comments about travel nurse taxes and state tax returns.

In previous articles I have pointed out the difference between a permanent residence and a tax residence. For this to apply however the travel nurse must meet 2 out of 3 of the following criteria. This illustrates that the total value of the contract with taxed and untaxed income.

Then add taxed and untaxed. Any phone Internet and computer-related expensesincluding warranties as well as apps and other. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses.

Travel nurse tax tips. One of the primary terms you will hear when filing your taxes as a traveling nurse is tax home. But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence.

As a travel nurse you have a unique career experience traveling across the country providing care to patients in needNurses love the freedom flexibility and adventure of becoming a traveling nurse. Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient when it comes to requesting extensions. You will owe both state where applicable and federal taxes like everyone else.

1 A tax home is your main area not state of work. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. I could spend a long time on this but here is the 3-sentence definition.

Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having. A 1099 travel nurse handles all their documentation and taxes themselves. If you need more time feel free to ask for it.

State travel tax for Travel Nurses. The costs of your uniforms including dry cleaning and laundry costs.

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Talking Travel Nurse Taxes The 50 Mile Rule The Gypsy Nurse

How To Make The Most Money As A Travel Nurse

Trusted Event Travel Nurse Taxes 101 Youtube

Tax Tips Receipts To Save As A Travel Nurse Rnnetwork Travel Nursing Blog

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

State Tax Questions American Traveler

6 Things Travel Nurses Should Know About Gsa Rates

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Tax Faq With The Founder Of Travel Tax Youtube

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Travel Nurse Tax Pro Home Facebook

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Taxes And The Travel Nurse Travel Nursing Travel Nurse Quotes Travel Nursing Agencies

Travel Nurses Are In High Demand Are You Eligible To Travel Travel Nursing Travel Nursing Companies Nurse

Trusted Guide To Travel Nurse Taxes Trusted Health

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing